Uganda’s Internet Access and connectivity verses Social Media Tax.

Uganda government’s taxing syndrome has hit social media users with an introduction of a daily levy of UGX 200 an equivalent of $0.05 to all users of social media platforms like Facebook, Twitter, Viber and WhatsApp among others.

The tax proposal was endorsed on May 30, 2018 by Members of Parliament under the new Exercise Duty (Amendment) bill 2018, which also imposes 1% levy on the total value of mobile money transactions.

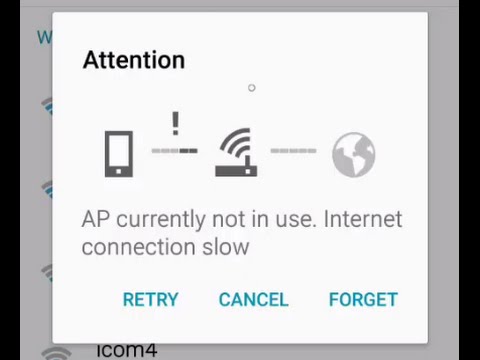

The social media tax comes at a time when the country is struggling with Internet coverage and speed causing digital divide. Uganda is running on maximum Internet speed at 2.4mbps downloads and 2.2mbps uploads compared to neighboring Kenya, which is running on 1.6gbps among countries in the region. So imposing a tax on such a low speed internet further burdens the users who are currently not getting value for their money from Internet service providers.

The move is likely to further widen the existing digital divide and would make internet extremely unaffordable to vulnerable groups like women, children, people with disability and youth, yet it is currently a driver to freedom of expression and transformation.

Uganda has a population of over 40million people and only 13million people have access to the internet with majority Ugandans kept offline because of either lack of connectivity, affordability or illiteracy among others.

It is estimated that 72.21% connecting via mobile enabled devices converting airtime which is already being taxed by the tax body, Uganda Revenue Authority, so taxing social media use will impose a double tax to users.

Imposing a tax on the struggling internet does not only hinder the Internet freedoms, ICT growth and coverage but contradicts with government’s vision 2040 which focuses on ICT as an engine for economic and social development.